BALANCING THE DWBA STRUCTURE FOR BUDGETS AND MONITORING

INTRODUCTION

This blog continues the sequence of an on-going series of articles which is intended to provide summarised information about Domestic Well-Being (DWB) accounting.

The whole reason for implementing an accounting system is so that its user(s) can establish and achieve control of the underlying financial system being modelled. In this context, we are interested in the management and control of the finances of an individual or a domestic, household situation.

Prior to the previous blog which looked at the way-ahead for domestic accounting and which introduced the need for system providers to migrate from off-the-shelf personal accounting software packages to modern, Software as a Service (SaaS) server-based programs, I discussed the subject of DWBA reports.

This blog addresses the control of personal finances with an introduction to prototypes of some innovative new tools for dynamically creating budgets and monitoring financial activity against those budgets.

In more detail, these tools are intended to help obtain an optimum balance across the structure at the heart of the new DWB accounting model, develop corresponding budgets and to then monitor performance against those budgets. When required if things are not proceeding to plan, it would be necessary to simply repeat the budget cycle as often as needed but typically, at 3-monthly quarters.

REPORTS

The main report for control purposes is the Domestic Well-Being Statement (DWBS). This report, replacing the business-style Trading and Profit & Loss reports, details the changes that may have occurred over the previous financial period, typically 1, 3, 6, 9 or 12 months – but the longer the better.

You will recall from earlier blogs that this report represents the hierarchical DWB structure with categories and levels of sub-categories for both the Increases and Decreases to the finances that may have occurred over some period.

Another report, the Domestic Balance Sheet (DBS) gave us the static information about our various assets and liabilities of different types on a particular day, usually the last day of the period. The changes over a period obtained from the DWBS, equate to the overall change in the static financial position occurring between the beginning and the end of that period under consideration.

Let’s now look at some views of the DWBS where we are looking at the changes that were recorded from transactions in a sample, year’s worth of financial data used as the example set of accounts for my book ‘Accounting for a Better life’.

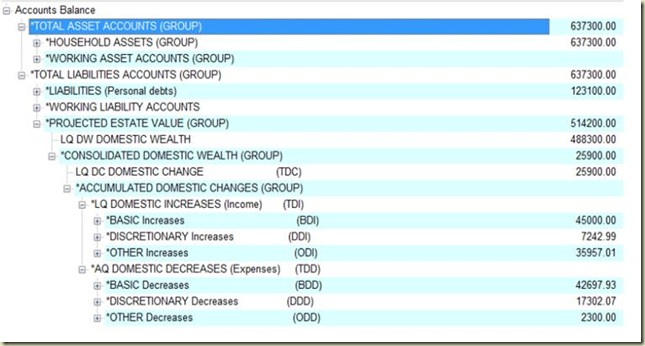

The images you see are from an implementation of the DWB accounting model in an off-the-shelf accounting package called Personal Accountz©. This first view shows the top level of the changes that have occurred over the year:

The first six rows are about the static elements of our financial situation – our assets and personal liabilities or debts – plus some so-called temporary working accounts used to mediate certain financial activity.

Next, we have the projected value of our estate, made up of our Domestic Wealth as at the last time we recorded it – at the beginning of the current period - plus the accumulated changes during the current period. You can see that the Total Domestic Change (TDC) is £25,900 made up of two groups, for Increases (LQ Domestic Increases) and Decreases (AQ Domestic Decreases); the + signs indicate that there is more detail available at lower sub-category levels.

The prefixes LQ and AQ stand for quasi-liabilities and quasi-assets, respectively; where these account name prefixes are discussed in a previous blog on ‘DWBA Accounting – Some Theory’.

The totals of the increases and decreases are not visible here because their values of £88,200 and £62,300 respectively have already been moved to the TDC account giving us the difference, being a surplus value of £25,900. I call this a Domestic Surplus (Domplus), in contrast to a Domestic Deficit (Domicit) when the decreases would have exceeded the increases over some period. This is the domestic or household equivalent of business profit or loss.

If we click on the two + tabs against Increases and Decreases, we see the next lower levels of the DWB structure with the sub-totals for the Basic, Discretionary and Other (non-Discretionary) categories for each of them.

Now we can begin to see the high-level balance, or perhaps lack of balance, in the structure of a year’s worth of personal or household financial activity – a high value for ‘Other’ Increases and relatively low ‘Discretionary’ Decreases.

A BALANCING TOOL

Once the figures for a past complete or part-period have been examined, what was needed was an easy and visually appealing way to undertake the balancing process for the next period. A prototype balancing and budget creation tool has now been added to the DWB accounting model repertoire that does just that.

The way the new tool works is by overlaying a series of adjustable bars, on top of bar charts for the figures accumulated for the previous or current period. The required Balance amongst the categories for a new budget can be achieved by simply adjusting the length of the various bars in an iterative way, compared to those of the previous period.

Without knowing too much yet about the significance of Basics, Discretionary and Others, separately for both the Increases and Decreases, we have the first indication of what the current balance at the end of the last period looks like. Having said looks like, a picture will give us a better view so here is a bar chart view of what we have seen and know so far from the DWBS report:

This overview-level view shows how the totals for the Increases (blue) and Decreases (red) for an accounting period are made up and what the relative distribution looks like amongst those top-level DWB Categories. The green bars are for our new planned budget arrangement, hopefully adjusted to achieve the best possible DWB balance.

The heading shows us that we are looking at values for the past 12 months for our ‘Last Period’ so we are looking at the situation at the end of a 12-month period where we might be developing a budget for the next 12 months.

All the values associated with each of the bars are shown at the end of each bar as both an actual value (the first figure – in whatever currency - £ here), as well as this value in a normalised format, as the second figure.

For the normalised values, the higher of the totals for the Increases or Decreases amounts are associated with 1.0 and all the other displayed values are therefore shown as a proportion of 1.0; so for these DWB example figures, the Increases were higher than the Decreases so the Increases total of £88,200 is equated to 1.0 and the Decreases of £62,300 therefore can be seen to have a normalised value of 0.71 and all the other normalised bar values are displayed accordingly.

Normalisation gives us a quick way to see relative differences between the values – if you prefer percentages, just mentally multiply the normalised values by 100. What we see here is that the Decreases were about 70% (0.71) of the Increases during the last period.

At this point at the end of one period, we would probably be interested in deciding what changes we might we wish to see by the end of the next period, in a years time. Let’s look further at the tools at our disposal.

The new objects are a series of ‘sliders’ associated with some new bars shown in green in these views. The sliders can be grabbed and moved with a mouse or clicked on the arrow-heads at either end of the slider to achieve more controlled incremental changes in the amount and length of each of their linked bars.

Some of the green bars representing totals for subordinate groups of bars are not associated with sliders themselves but move to show the accumulated effect of moving sliders in the subordinate bars that are contained in their represented totals.

There are movable bars for the main DWB Categories for both the Increases and the Decreases where the purpose at this overview-level is to make changes for the future desired amounts of the particular quantities associated with each bar.

For example for Increases, there may be a known salary increase expected so this can be factored into the Basic Increases for next year or for the remainder of the current period if we are re-balancing some way into a period.

With knowledge of the details of what happened last year, you would know that the relatively high amount of Other Increases last year was due to an inheritance from Uncle Jo and so the projected amount for Others for next year can be correspondingly reduced with little likelihood of another inheritance.

As changes are made to the lower, more detailed levels for Basic, Discretionary and Others, the corresponding Totals bars will also change in amount and length, dynamically.

At this overview-level, the issues will be about the relative balance or proportions of the desired amounts for the three DWB Categories making up Decreases – Basics, Discretionary and Others (non-Discretionary). These will be viewed in relation to last year’s amounts, the likely Increases for next year and the resulting Domplus or Domicit that can be accepted or is desired for next year.

In contrast to maximising profits in business, our domestic life seeks only a modest and steady increase in Domestic Wealth but from the DWB perspective, we look for a better balanced set of financial decreases to ensure that the best possible ‘life’ is being experienced within the applicable constraints.

The predicted wealth based on our developing budget can be seen from the moving, Total Domestic Change (TDC) bar, included at the top and bottom of the complete chart. Here, the projected figures for the TDC for next year is highlighted; this is shown in comparison to the static bar/figure for last year, and where the TDC for next year can be seen to change as the projections are being made with the sliders for the Increases and Decreases for next year.

Other overview-level inputs that maybe appropriate, result from decisions made in respect of reducing any existing debt over the coming year and the need for any new, short to medium-term savings, over and above regular provisions for the future, hopefully managed under the Investment for the Future (IFF) sub-category.

From the static data in the DBS, also visible on the main Accountz screen, the level of personal current debt accumulated might be considered unacceptably high and a decision made to reduce it by some achievable amount, over the forthcoming period.

The planned re-payments to do this over the coming period will have to be balanced alongside all the other decreases earmarked for the next period and the selected future target reduction in personal debt should therefore be entered using one of the two bars, under Discretionary Balancing.

Any need for a particular accumulation of funds as short to medium-term savings, to replace an old car for example, should be entered with the second bar at this level, under Discretionary Balancing.

As you progress down to the lower levels of the balancing process, difficulties discovered in achieving a workable balance at the lower levels may well require a return to either or both the intermediate and top levels to alter some previously chosen values. The very nature of the hierarchical description of the characteristics of financial behaviour behind the DWB structure implies that an iterative process will be required to achieving an optimal balance.

Each adjustable bar used for planning future financial activity is identified with characters relating to its sub-category identity e.g. ‘D’ for debt; ‘S’ for savings and ‘1F’ for Car1 Fuel. There is also an additional pair of numbers at the end of some of the planning bars; these represent the annual and monthly future change compared to the previous period, required for this sub-category in order to achieve the new amount of increase or decrease represented by the length of the particular bar. This number changes dynamically as the length of each bar is adjusted and similar changes are reflected in the figures of associated higher-level Totals.

Colour as mentioned earlier is also used to help distinguish particular types of bar – blue for previous period increases, red for previous level decreases, green for selected budget values for the next period and blue for values previously selected/budgeted at higher levels of the iterative budget creation process.

The target to be met by balancing lower level sub-categories at any particular level of balancing is therefore the blue bar amount shown at this level, established by previous balancing at the next higher level.

Returning to the DWBS, we need to expose some lower levels of detail so here is another view with the next lower level of sub-categories for the Increases, opened up:

Now let’s look at more detail for the Decreases for the current period – already with some of the intermediate levels of the DWB structure visible:

Here we can see the two main sub-categories of Basic Decreases, the Essentials and Responsibilities with their next, lower-level sub-categories.

We can of course keep on drilling down to see more and more detail, right down to individual financial transactions.

The power of this structure and the resulting figures for some reporting period mean that we now have a basis for quite detailed decision-making for the future.

The whole concept behind DWB accounting is towards achieving the best possible balance of personal or household finances and hence, achieving a better life within the prevailing constraints.

By this, we want to get a proper balance across all the categories of expenses. We want to avoid spending excessively in some areas to the detriment of spending in other areas.

By ensuring that we spend proportionately in all areas, the implication is that we should experience a better overall life since we should be obtaining the benefits and rewards of all the many categories of purchased produce, items and activities that make up the typical, day-to-day lifetime experience.

The DWBS figures enable us to search for balance and as we are seeing, dynamically alter how we want this balance to look for the future.

This will always be in order to obtain the best possible balance within the prevailing constraints. These constraints as we have seen are essentially the increases, as income, together with any existing debt that needs to be reduced and any new requirement to accumulate particular amounts as savings for short to medium-term financial priorities – e.g. that car replacement.

After that, the priorities are first, to make sure that for the Decreases, care is taken of the Basics in terms of both the Essentials (food, clothing, accommodation, utilities, etc.) and the Responsibilities that we all experience - such as taxes, household obligations, professional expenses, garden maintenance, etc.

Next, at the Discretionary category of Decreases we should ensure that we have equitable and balanced expenditure across the Nice-to-Have’s of Holidays, Leisure and Entertainment, and Hobbies; as well as the all-important, Investment for the Future (IFF).

With the likelihood of an ever-inadequate future pension, it is even more important that everyone makes their own adequate additional provision for the future. This means ensuring that appropriate amounts are stored away or invested on a regular basis and it is common knowledge that the earlier the start is made, the easier the process and the greater the future pension or provision for the future is likely to be.

DWB addresses amounts to save but specialist advice would be required on the choice of investments and how best to benefit from such investment in practise.

As ‘balancing’ decisions are made at the higher levels of the structure, it will then be necessary to go to the lower-level sub-categories to determine what more detailed changes need to be made at these lower levels and below, by balancing in more detail, in order to achieve the balance envisaged by the top-level decisions.

As we have begun to see, it turns out to be an iterative process where difficulties might be discovered in achieving the required balance at the lowest levels. This usually implies a return to the intermediate or top levels for possible further redistribution across the sub-categories, or even to go back to the overview-level to accept and to readjust those amounts accordingly. This is because these first-cut high-level targets might now appear unachievable in practice when balancing at all levels has been attempted.

Understandably, you cannot try to achieve the impossible. Your desired balance within all the levels have to match the likely Increases. Of course you might well conclude that you need more qualifications and a better job to achieve the lifestyle to which you aspire! This is just another feature of the visibility on your finances provided by the DWB accounting model.

BUDGETS

In general, what we are trying to do is to work out what we would like the future figures at the end of some period, to look like. Budgets are lists of figures or targets for financial activity, most often for expenditure, and will be most useful if these figures can estimate target amounts at varying future points – say 3-months, 6-months, 9-months and on to the end-of-year, 12 months ahead.

The main by-product of the new structured, dynamic balancing tool is a set of budget amounts for every sub-category of the DWB structure, at all of the required, future 3-month quarterly points.

Obviously for a home or domestic situation, we do not want to overdo things by trying to control everything in too much detail so it will be important for users to select for actual control purposes, just the figures for the sub-categories for budgetary control that have the most impact. By this, we need to concentrate on making decisions on trying to reign-in spending in areas that we find are in most need of cutbacks or for re-balance.

We also need to try to control areas where there is an element of flexibility or choice to make it possible to actually achieve the implied future changes through corresponding changes in spending patterns (with appropriate self-control and discipline!). This might involve deliberate decisions to cut back on some utilities, car usage, food costs, luxuries and so on.

Let’s now look at some of the lower levels of the balancing process. There are four levels of balancing available with DWB to be used as needed and not every sub-category of Decreases will be expanded to be balanced in detail at the level in which it lies:

Overview level

Top level

Intermediate level

and Low or Bottom level

We have so far looked at the Overview level where those general decisions were made in regard to likely future Increases and the desired distribution and amounts of future Decreases at the major category level.

The next three levels only address Decreases as there is very little more to be said or controlled at the lower level, DWB sub-categories for Increases.

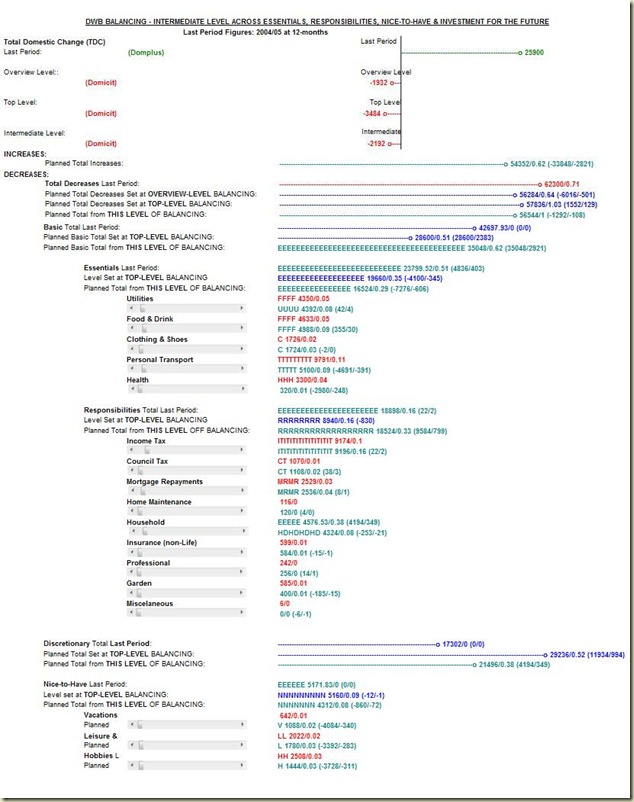

Here is the balancing tool being used at the Top level, for Decreases:

The new objects are a series of ‘sliders’ associated with some new bars shown in green in these views. The sliders can be grabbed and moved with a mouse or clicked on the arrow-heads at either end of the slider to achieve more controlled incremental changes in the amount and length of each of their linked bars.

Some of the green bars representing totals for subordinate groups of bars are not associated with sliders themselves but move to show the accumulated effect of moving sliders in the subordinate bars that are contained in their represented totals.

There are movable bars for the main DWB Categories for both the Increases and the Decreases where the purpose at this overview-level is to make changes for the future desired amounts of the particular quantities associated with each bar.

For example for Increases, there may be a known salary increase expected so this can be factored into the Basic Increases for next year or for the remainder of the current period if we are re-balancing some way into a period. With knowledge of the details of what happened last year, you would know that the relatively high amount of Other Increases last year was due to an inheritance from Uncle Jo and so the projected amount for Others for next year can be correspondingly reduced with little likelihood of another inheritance.

As changes are made to the lower, more detailed levels for Basic, Discretionary and Others, the corresponding Totals bars will also change in amount and length, dynamically.

At this overview-level, the issues will be about the relative balance or proportions of the desired amounts for the three DWB Categories making up Decreases – Basics, Discretionary and Others (non-Discretionary). These will be viewed in relation to last year’s amounts, the likely Increases for next year and the resulting Domplus or Domicit that can be accepted or is desired for next year.

In contrast to maximising profits in business, our domestic life seeks only a modest and steady increase in Domestic Wealth but from the DWB perspective, we look for a better balanced set of financial decreases to ensure that the best possible ‘life’ is being experienced within the applicable constraints.

The predicted wealth based on our developing budget can be seen from the moving, Total Domestic Change (TDC) bar, included at the top and bottom of the complete chart. Here, the projected figures for the TDC for next year is highlighted; this is shown in comparison to the static bar/figure for last year, and where the TDC for next year can be seen to change as the projections are being made with the sliders for the Increases and Decreases for next year.

Other overview-level inputs that maybe appropriate, result from decisions made in respect of reducing any existing debt over the coming year and the need for any new, short to medium-term savings, over and above regular provisions for the future, hopefully managed under the Investment for the Future (IFF) sub-category.

From the static data in the DBS, also visible on the main Accountz screen, the level of personal current debt accumulated might be considered unacceptably high and a decision made to reduce it by some achievable amount, over the forthcoming period.

The planned re-payments to do this over the coming period will have to be balanced alongside all the other decreases earmarked for the next period and the selected future target reduction in personal debt should therefore be entered using one of the two bars, under Discretionary Balancing.

Any need for a particular accumulation of funds as short to medium-term savings, to replace an old car for example, should be entered with the second bar at this level, under Discretionary Balancing.

As you progress down to the lower levels of the balancing process, difficulties discovered in achieving a workable balance at the lower levels may well require a return to either or both the intermediate and top levels to alter some previously chosen values. The very nature of the hierarchical description of the characteristics of financial behaviour behind the DWB structure implies that an iterative process will be required to achieving an optimal balance.

Each adjustable bar used for planning future financial activity is identified with characters relating to its sub-category identity e.g. ‘D’ for debt; ‘S’ for savings and ‘1F’ for Car1 Fuel. There is also an additional pair of numbers at the end of some of the planning bars; these represent the annual and monthly future change compared to the previous period, required for this sub-category in order to achieve the new amount of increase or decrease represented by the length of the particular bar. This number changes dynamically as the length of each bar is adjusted and similar changes are reflected in the figures of associated higher-level Totals.

Colour as mentioned earlier is also used to help distinguish particular types of bar – blue for previous period increases, red for previous level decreases, green for selected budget values for the next period and blue for values previously selected/budgeted at higher levels of the iterative budget creation process.

The target to be met by balancing lower level sub-categories at any particular level of balancing is therefore the blue bar amount shown at this level, established by previous balancing at the next higher level.

Returning to the DWBS, we need to expose some lower levels of detail so here is another view with the next lower level of sub-categories for the Increases, opened up:

Now let’s look at more detail for the Decreases for the current period – already with some of the intermediate levels of the DWB structure visible:

Here we can see the two main sub-categories of Basic Decreases, the Essentials and Responsibilities with their next, lower-level sub-categories.

We can of course keep on drilling down to see more and more detail, right down to individual financial transactions.

The power of this structure and the resulting figures for some reporting period mean that we now have a basis for quite detailed decision-making for the future.

The whole concept behind DWB accounting is towards achieving the best possible balance of personal or household finances and hence, achieving a better life within the prevailing constraints.

By this, we want to get a proper balance across all the categories of expenses. We want to avoid spending excessively in some areas to the detriment of spending in other areas. By ensuring that we spend proportionately in all areas, the implication is that we should experience a better overall life since we should be obtaining the benefits and rewards of all the many categories of purchased produce, items and activities that make up the typical, day-to-day lifetime experience.

The DWBS figures enable us to search for balance and as we are seeing, dynamically alter how we want this balance to look for the future.

This will always be in order to obtain the best possible balance within the prevailing constraints. These constraints as we have seen are essentially the increases, as income, together with any existing debt that needs to be reduced and any new requirement to accumulate particular amounts as savings for short to medium-term financial priorities – e.g. that car replacement.

After that, the priorities are first, to make sure that for the Decreases, care is taken of the Basics in terms of both the Essentials (food, clothing, accommodation, utilities, etc.) and the Responsibilities that we all experience - such as taxes, household obligations, professional expenses, garden maintenance, etc.

Next, at the Discretionary category of Decreases we should ensure that we have equitable and balanced expenditure across the Nice-to-Have’s of Holidays, Leisure and Entertainment, and Hobbies; as well as the all-important, Investment for the Future (IFF).

With the likelihood of an ever-inadequate future pension, it is even more important that everyone makes their own adequate additional provision for the future. This means ensuring that appropriate amounts are stored away or invested on a regular basis and it is common knowledge that the earlier the start is made, the easier the process and the greater the future pension or provision for the future is likely to be.

DWB addresses amounts to save but specialist advice would be required on the choice of investments and how best to benefit from such investment in practise.

As ‘balancing’ decisions are made at the higher levels of the structure, it will then be necessary to go to the lower-level sub-categories to determine what more detailed changes need to be made at these lower levels and below, by balancing in more detail, in order to achieve the balance envisaged by the top-level decisions.

As we have begun to see, it turns out to be an iterative process where difficulties might be discovered in achieving the required balance at the lowest levels. This usually implies a return to the intermediate or top levels for possible further redistribution across the sub-categories, or even to go back to the overview-level to accept and to readjust those amounts accordingly. This is because these first-cut high-level targets might now appear unachievable in practice when balancing at all levels has been attempted.

Understandably, you cannot try to achieve the impossible. Your desired balance within all the levels have to match the likely Increases. Of course you might well conclude that you need more qualifications and a better job to achieve the lifestyle to which you aspire! This is just another feature of the visibility on your finances provided by the DWB accounting model.

BUDGETS

In general, what we are trying to do is to work out what we would like the future figures at the end of some period, to look like. Budgets are lists of figures or targets for financial activity, most often for expenditure, and will be most useful if these figures can estimate target amounts at varying future points – say 3-months, 6-months, 9-months and on to the end-of-year, 12 months ahead.

The main by-product of the new structured, dynamic balancing tool is a set of budget amounts for every sub-category of the DWB structure, at all of the required, future 3-month quarterly points.

Obviously for a home or domestic situation, we do not want to overdo things by trying to control everything in too much detail so it will be important for users to select for actual control purposes, just the figures for the sub-categories for budgetary control that have the most impact. By this, we need to concentrate on making decisions on trying to reign-in spending in areas that we find are in most need of cutbacks or for re-balance.

We also need to try to control areas where there is an element of flexibility or choice to make it possible to actually achieve the implied future changes through corresponding changes in spending patterns (with appropriate self-control and discipline!). This might involve deliberate decisions to cut back on some utilities, car usage, food costs, luxuries and so on.

Let’s now look at some of the lower levels of the balancing process. There are four levels of balancing available with DWB to be used as needed and not every sub-category of Decreases will be expanded to be balanced in detail at the level in which it lies:

Overview level

Top level

Intermediate level

and Low or Bottom level

We have so far looked at the Overview level where those general decisions were made in regard to likely future Increases and the desired distribution and amounts of future Decreases at the major category level.

The next three levels only address Decreases as there is very little more to be said or controlled at the lower level, DWB sub-categories for Increases.

Here is the balancing tool being used at the Top level, for Decreases:

At this Top level below the Overview-level, we examine the past amounts spent and the distributions across the Basic sub-categories of Essentials and Responsibilities, and the Discretionary sub-categories of Nice-to-Have, Investment for the Future (IFF), Luxuries and a catch-all of Miscellaneous Disposals; for example we may have decided next year that a major gift is to be made, perhaps for a forthcoming wedding.

Here is an example of the results of Intermediate-level balancing:

At the Intermediate level, we begin to try to achieve a balance within certain of the sub-categories that we balanced at the Top level. For example, for the Essentials category, we try to achieve a balanced spread of planned decreases for the sub-categories comprising Essentials (Utilities, Food & Drink, Clothing & Shoes, Personal Transport expenses and Health) that equals the value selected for Essentials at the higher (Top) level.

At the lower levels, only a few and appropriate sub-categories would be subject to detailed balancing. These could include Utilities and Transport from Basic/ Essentials, and Leisure and Entertainment, and Hobbies from Discretionary/ Nice-to-Have, because these are areas which are more amenable to detailed control over the coming period, through active expenditure control.

This screen shot illustrates the sliders used to balance the Utilities and Transport expenses sub-categories of the Essentials sub-category of the Basic decreases:

The starting points for decision-making and hence budget preparation regarding future financial activity vary from a start-up position where no previous figures are held, right through to the start of a new period (financial or calendar year perhaps) where all the figures for the previous period have been retained. This is the situation we have been looking at above.

Intermediate between these two extremes will be the situation where some figures for the previous quarter(s) perhaps or where a particular number of days have elapsed since data accumulation first started.

Where part-period figures are held, they can be scaled-up by the tool to the end of the current period. In this way although not completely accurate, we can see how, based on figures to-date, we might be likely to ‘do’ by the end-of-period if nothing changed.

A budget produced from these figures will be more meaningful than one produced from a complete guess. Obviously as time goes by and more figures are accumulated, a new budget creation exercise will benefit from less scaling-up and therefore more accurate, likely target figures for the remaining time to the end of the current period.

The balancing process can be extremely quick to complete and considering that it would only need to be undertaken periodically, at say 3-monthly intervals, it is hardly a demanding overhead.

Here are the budget results obtained after balancing has been completed. It shows sample budget figures available for whatever purpose the user wishes:

Typically, selected values would be inserted into the user’s accounting package so that as time progresses, the actual figures accumulated could be compared to the pre-set budget quantities so that alarms would be triggered where deviations from the desired expenditure amounts were detected.

Budgets could be set not only for categories of expenses, as decreases, but also for credit card balances to warn against exceeding pre-set debt limits. It would be pointless to save in order to cut down existing debt levels whilst incurring additional debt with over zealous credit card usage.

By saving sets of planned budget settings based on this slider-based balancing process, comparisons can be undertaken in the future with this tool through monitoring. This is done by overlaying the budget figures with the actual recorded expenditure figures. If appropriate, a new budget can be created to provide new projected figures whenever needed.

MONITORING PROGRESS

As we progress through the next financial period it will be helpful once budget figures are set, if we can see how we are doing in relation to those target figures. How you accomplish this will depend on the details of your accounting package but most good systems allow you to enter pre-set budget figures.

By establishing intermediate check-points at those 3-monthly intervals perhaps, we will be able to determine if we are on-track, need to do better, or perhaps have done rather better than expected in some areas and hence have an opportunity to re-adjust our budget figures for the next interval by revising the budget creation exercise. In this way, areas that were proving difficult to keep to budget might be given more leeway from surpluses found in other areas so that the overall target might still be achieved with focussed re-planning along the way.

Another version of the balancing tool can be used to assist the monitoring process and is not associated with any budgeting controls that may be available as part of the accounting package used. The two overlaid sets of bars in this monitoring chart enable comparison of a saved set of budget amounts with the actual state of real increases and decreases as accumulated in the accounts.

Areas where attention will be needed will be obvious, either with the need for stricter adherence to the existing plan, or possibly a re-planning exercise leading to a modified set of budget figures for the remainder of the period.

The next screenshots show the monitoring with budget figures including the quarter points (1, 2, 3 and 4) in blue with the corresponding actual figures below each blue bar, in green. Sliders are interspersed amongst the bars to facilitate dynamically changing the scales of the bars in groups, to make interpretation as easy as possible with the varied range of values to be displayed. The actual figures in these images are as-at the end of the First quarter so we would be looking for correspondence between budget and ‘Actuals’ at the ‘1’ in the blue budget bars.

The only real concerns in this example which would require further investigation would be the high value for car maintenance in Personal Transport expenses which puts the Basic/Essentials, over-budget. Knowing about the finances, we would be aware that this was due to an unexpectedly high bill for car repairs!

Another display not shown here is the Dashboard used to select the figures – previously saved results from the accounts, with or without scaling, for budget preparation; as well as the budgets and actual figures to be used for monitoring.

DEBT ADVICE

Apart from its use for private individuals or for accountants responsible for the personal financial affairs of some of their clients, it is believed that these balancing and monitoring tools could also be extremely helpful for debt advisors.

With knowledge of a client’s financial affairs, a client-budget could be relatively easily established by an advisor using the Balancing tool and readily available statistics about the typical distribution of household expenses.

Particular emphasis would have to be given to putting aside appropriate amounts over a period for reducing the existing debt and balancing this with a plan for tailored, barebones living expenses. The situation could then be monitored by use of DWB accounting and the budget adjusted periodically, as needed by the advisor with client involvement, as time unfolds.

Hopefully the client would see the benefits of this form of financial management so as to be able to continue using it for themselves to achieve a continuing and improved lifestyle once the debt had been cleared.

CONCLUDING THOUGHTS

There is a real need for the eventual availability of integrated toolsets for personal and household financial management (aka accounting) including the concepts of the budgetary and monitoring support described here. They would preferably be available as online SaaS implementations, for the reasons given in my previous blog. With this, private individuals together with other finance professionals including accountants and debt advisors could be given the means, perhaps for the first time, to really have a chance to relatively easily and effectively gain and maintain control of the personal and household finances for themselves or their clients.

![clip_image002[5] clip_image002[5]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi8oM4VUEel3g_Q1m-SmJX_qxHInM_omhaNy5maMPe7byis_IEa1SG-8OWLm4MCF7lAwJr9iUfdWxn9FNRwJsSbiIqSw7IG5X108GTf91xHorMUPz8srM_I4qSZB3q_qMP4LDxiyAz2BX8/?imgmax=800)

![clip_image002[9] clip_image002[9]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhOLqUJ6UJCUnLxVxq7injQ_cZdq64-Hm3sGawZvxMxmdLEh-a2sum4sUMYzYnVEXQ3YPzpOG9kwdjXGWteXnNw6zZXvT5JymHiULGn5Nq3MFbXNx44iDUr-twiwKSA6dunebQryG3fuUw/?imgmax=800)