We had a first look at Reports in my last blog so it is now appropriate to take a step back and talk a little bit about some accounting theory in the context of the Domestic Well-Being (DWB) accounting model.

You might find the theory a little intimidating at first but it is here for those who wish to really understand what is going on and to make it easier to atually do. I will summarise the important parts at the end and all you will actually need in order to start doing this sort of accounting is to be able to look at and interpret some fun, memory joggers which tie the theory together!

In developing the DWB accounting model, my overriding aims were focus and simplicity. My earlier attempts to use business accounting methods for personal accounting had proven very unsatisfactory because I realised that the business accounting model had the wrong focus for home use and it was all too difficult to understand and to do, on a day-to-day basis.

Since I wanted to run my accounts in a continuing way, year after year, and I wanted to capture the complete household financial picture, I decided that business style double-entry techniques were important (more about that in a moment) and had to be a part of the new accounting model. Because of this, I needed to find an easy way to remember which accounts to use whenever transactions were entered into the accounting system and which side of an individual account did each entry go; and was it an addition, or a subtraction?

So the DWBA model includes not only the new focus and methods to make it all work, but a set of corresponding supporting techniques including some new terminology, naming-conventions and some memory joggers. In this blog, space and time permits only an overview of the theory but the intention is to provide sufficient to convince you that there might really be some mileage in further investigating DWB accounting.

Business accounting is plagued with words that only accountants probably ever feel really comfortable with. Words like capital, equity, asset, liability, debit, credit, income, expense and many more, are not easy to take on board. Partly because we hear some of them in everyday life, particularly debit and credit, in contexts which we may not truly understand, we can end up with an incorrect idea of what some of these concepts really mean. In fact we cannot avoid all the words but with some targeted theory, I have found that it can be made to make a little more sense and with some aide-memoires, it becomes quite ease to understand what is going on behind the scenes in accounting.

The adapted background theory which I think is sufficient to meet that first aim, of simplifying accounting, covers the following features:

- 1. Accounts and overarching types – Asset and Liability

- a. An Account

- b. Asset Accounts

- c. Liability Accounts

- 2. Scope of Accounts

- 3. Double Entry concepts

- 4. Domestic Accounting Equation (DAE)

- 5. Working Accounts

- 6. Categorising Changes

- 7. Account Naming Conventions

- 8. Making Use of the Account Types

- 9. Keeping the Accounting Balance

- 10. Conquer From/To, Debit/Credit and Income/Expense Relationships

- 11. Bookkeeping and Categorising Information

- 12. Summary

1. Overarching Account Types

a. An Account

Starting at the beginning, we should realise that a single account is simply a time-sequenced list of changes to some particular area of financial activity going on in the background. An account will normally have an account title for the area of interest, such as cash, current bank, savings, car loan, main residence and so on. It is important to realise that an account is always associated with some sort of value.

This value may be for money as ‘liquid’ cash or for amounts stored in current or different bank savings accounts. An account may also be created to provide a record of the changing value of the home, car or a holiday, where the monetary value of the designated object might change over time, perhaps with gains, losses or appreciation and depreciation.

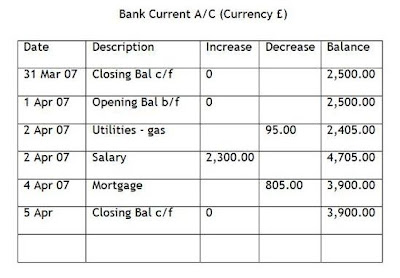

The transactions making up or entered into an account will address changes to the amount of its balance and each typically includes a date, a description and/or a reference to the activity causing the change, as well as the actual value in a separate column according to whether it is an increase or decrease of any amount held in the account. Computerised accounts will often include a running total to show the changing balance of the account after each transaction is applied.

Printed account extracts will usually also include the opening and closing dates and balances; these can be made obvious in the accounts by including zero-balance transactions at the start and end dates of a period with descriptions such as Opening Bal b/f (brought forward) or Closing Bal c/f (carried forward).

This simplified account in our accounts for a current account at a bank with a minimum number of column headings, shows just a few entries before the end of the UK financial year on the 5th of April.

It is important to distinguish between increasing and decreasing amounts of change to an account compared to the corresponding changing value in the account because these will not always be the same, as we will see shortly.

b. Asset Accounts

The balance of an asset type account where positive amounts represents positive value is typically used to accumulate financial information about cash deposits, a house, a car or an investment. We will see later that asset accounts can also be used for some special information in so-called Working and Quasi-asset accounts. That salary increase above of £2,300 is known as a debit or income entry because debit always means increasing value whilst in contrast, a decrease in value –for the gas or mortgage payments above – is known as a credit or expense entry.

The words income and expense here are types of entry related to value (like debit and credit) and should not be confused with salary as a particular form of income or the purchase of food as a particular sort of expense. Quite obviously, you will enter income received into one of your bank accounts into an appropriate asset type account in your own accounts, with a debit or income type entry. This is because it represents increasing value from the point of view of the entity which your set of accounts represent, which is you as an individual person or your household, if that is your situation.

To summarise our first rule; debit or income in an account represents increased or positive value whilst credit or expense represents decreased or negative value.

c. Liability Accounts

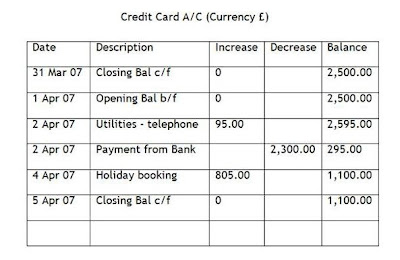

Another example of an account shows some entries for one of our credit cards. All the entries look basically similar to the last account except for one essential fact:

The essential difference is that this account represents financial activity relating to things purchased ‘on credit’ so it is all about value owed to someone or some organisation - a liability.

The Opening Balance of (+) £2,500 in this credit card account shows that we had already obtained credit of this amount relating to objects that we had purchased previously, less any payments we had already made to reduce our debt or amount owed. We have an outstanding charge of £2,500 by being given credit of this amount by the credit card company. We are in indebted to that organisation with a debt of £2,500 and we are one of its creditors who owe the card company this same amount.

As we make more payments ‘on credit’ we can see that in this type of account they are increasing positive numbers representing amounts of charge, more liability and therefore less overall value in our account. These additions go to increase the amount that we will have to pay back to the card company at some future time. Each of these transactions representing increases in liability implies less value and by the accounting rule, is therefore a credit or expense entry into that account.

A payment from our bank (a credit or expense entry from an asset type account) as one of those repayments is shown as a decrease in this Credit Card liability type account because the amount that we owe to the credit card company is reduced by this (positive) amount. Our liability is in effect, reduced by £2,300 and so this entry is a debit or income entry in a liability type account, signifying an increase of value because it reduced a liability – a double negative in mathematics! This is an example of a proper credit and debit entry pairing which as we will see, characterises double entry and maintains value in the whole collection of our accounts.

This account is an example of a liability account. A liability account is used to store amounts of value that are owed to someone or some entity and even to another account in our so-called, book of accounts and so they use positive numbers to represent negative value. Their positive balance and any increases (credit/expenses) represent negative value since more of a liability means that more is owed to whatever the account represents. Likewise, decreases or reductions in its positive balance imply less liability and therefore more value (debits/income). I refer back to that comment that I made about distinguishing between increasing amounts and values. In liability type accounts, more implies less! More of an amount in this account (an increase) represents less value (a credit or expense) whilst reduced amounts imply less liability and therefore more value.

Having introduced these two examples of different types of account, it is very important to distinguish between what I call overarching types of account versus the use to which these two types of account may be put, usually indicated in the account name.

So we have two overarching types of account or tools in our accounting toolbox. An asset type account is simply an account where a positive balance means positive value whilst in contrast, a liability type account is one where a positive balance implies a negative value. I shall come back to this distinction shortly when we begin to see what types of accounts are used for what purpose in an accounting system.

2. Scope of Accounts

We use accounting and accounts to model financial activity. In business where large organisations may have multiple departments or divisions, we can recognise that accounting may be applied to company-wide financial activity or separately, for the different sub-divisions. An accounting system therefore has a concept of scope or a boundary which determines the extent of financial activity to which it applies.

Similarly for a home, personal or domestic household situation, we can envisage that the financial activity could be considered from different levels of scale. Typically, a user of a home accounting software package might limit its scope to cheque reconciliation where the extent of the activity would be restricted to just that of the current account at a bank. For this, a single account would suffice and could be achieved with a personal accounting package or even a simple spreadsheet table. Where a family might have a current account as well as one or more savings accounts and some credit card accounts, they may wish to extend their accounting activities to include all these aspects of their home finances but still not address their complete financial picture.

We therefore have a concept of an accounting system which addresses differing scopes of all the financial activity within some specified scope or boundary.

In business, be it for a sub-division or subject area such as human resources – wages, salaries, taxes, national insurance, pensions, etc. accounting legally has to cover all aspects of financial activity within the specified scope; and all activity has to be covered, even it is subdivided into separate compartments with corresponding scopes and separate accounting systems.

Back to the domestic situation, financial activity obviously includes the bank and credit card arrangements we have already discussed, including all the increases and decreases being applied to them. However we mostly have some household assets (not thinking of asset accounts yet) such as a home, one or more cars, furnishings, appliances, maybe a caravan or time-share or even a boat as well as financial investments such as assurances, stocks, bonds and so on. We think of an asset, as opposed to expendables, as something having some residual value which maybe realisable so that we can get some money back in exchange for its disposal. We may never know that value until we achieve a sale but at least we can estimate its value as it changes over time, either up or down, in order to know the estimated and changing value of all our assets.

Another side of personal financial life relates to mortgages and loans, as well as those credit charges we already looked at. These are our personal liabilities or debts of different types.

Our day-to-day outgoings on food, utilities, health, transport, education, holidays, pensions, etc. actually represent the largest and most influential part of our household financial activity. This represents the bulk of the dynamics or changing part of this activity in contrast to the slow-to-change, relatively static personal assets and liabilities.

To really manage and control our personal or household financial activity we need to look at the complete financial picture. This means that we need to understand and know about both the static and dynamic parts of our domestic financial activity. This is because proper control of our finances has to consider all its aspects, our assets, our personal liabilities and the constant changes made up of the monies we receive and the constant stream of outgoings or decreases which characterise our domestic life.

The scope of our interest should be total and likewise the scope of the accounting system we build to model it should be all-embracing. Instead of just a few accounts to model our banks and credit cards, we should try to model all our changing assets, our obligations to others as mortgage debts, loans and charges, as well as our day-to-day increases and decreases required to stay alive.

By doing this in a way that is tailored to the characteristics of our household financial activity – such as by use of the DWB accounting model – we can obtain the visibility on it all to effectively gain and achieve the control we seek.

3. Double Entry Concepts

Double entry accounting is a simple concept having two implications:

It represents a total view of the financial activity within some designated scope or boundary that defines our accounting system.

It utilises two postings or entries in our accounts for each financial transaction to ensure that the complete set of accounts remain in financial and mathematical balance.

The total view requires that an extra account is created and maintained to store the total worth of the financial system or area of interest within the designated scope.

Double entries in bookkeeping where transactions are entered into the accounts require that value is ‘conserved’ by matching pairs of debit (Dr. gain) and credit (Cr. loss) postings. An increase in value must always be matched in the accounts by a corresponding decrease in value. We will see in a moment how this pairing of postings or entries is achieved where I emphasis 'From' and 'To' rather than Dr/Cr.

4. Domestic Accounting Equation (DAE)

I find that double entry accounting can best be explained by the use of the ‘accounting equation’ which I have adapted for domestic use.

Hopefully, accepting that the balances of all the accounts representing the finances of an entity must somehow be related, schooldays remind us that related numbers is what equations are all about! Where perhaps 20 numbers represent the 20 balances of these required accounts, we should be able to relate these 20 numbers meaningfully in an equation in some way.

The traditional Accounting Equation shows the financial relationship as:

Assets - Liabilities = Capital value or Shareholders or Owners equity.

The basic version of the Domestic Accounting Equation (DAE) is:

Assets - Liabilities = Domestic Wealth

In order to manage our finances with double entry accounts, we will need to create accounts for all our assets using those asset type accounts as well as sufficient accounts of the liability type for all our different personal debts or liabilities, plus at least one more account for our Domestic Wealth. So in terms of the Domestic Accounting Equation (DAE), we can say where a/c stands for account:

All personal Asset a/c balances (of the asset type) - All personal Liability a/c balances (of the debt type) = Domestic Wealth a/c balance

Thinking about it, the value of domestic wealth represented by the value of the assets less the value of all the personal debts is owed to the eventual beneficiaries of the household or individual’s estate. After death, the executors have to pay off the debts from the assets and what is left, the Domestic Wealth, will be shared out amongst the beneficiaries - so the domestic wealth is a sort of liability from the viewpoint of the entity represented by the set or book of accounts, an individual or a householder.

The domestic wealth is owed to the beneficiaries and therefore should logically reside in a liability type account. I decided that I needed to distinguish between personal liabilities and liabilities of the estate so that is why I defined ‘quasi’ liability accounts of the liability type to be used to hold the Domestic Wealth and some other associated accounts to handle changes to Domestic Wealth. Compared to true or personal liabilities held in current and long-term liability accounts which can be considered as 'bad' liabilities, Domestic Wealth can be considered a 'good' liability and so the set of quasi-liability accounts in DWBA distinguishes or highlights these good liabilities - the greater the positive amounts or the less of the corresponding value in them, the better!

Considering changes over some period, increases from salary or growth imply more wealth so logically; those increases should also be stored in some sort of liability type account, alongside the Domestic Wealth account. So we also need one of these quasi-liability accounts for accumulating domestic increases.

Conversely, decreasing amounts resulting from expenses such as on food, drink, hobbies and holidays, as well as depreciation and losses, should also logically be stored in a separate account. They mostly come from decreases in either one or other of our asset type bank accounts or one of our credit card liability type accounts. To store decreases of positive amounts of assets or positive amounts of credit, we need an account to accumulate these positive numbers and an asset type account is the appropriate sort of account to use. Remember that a decrease in a bank current asset account (credit) can be matched by an increase in another asset account (debit) or a decrease in a liability account (also a debit – creating more value).

If we choose a liability type account for accumulating these decreases, the two sorts of credit entries from bank or credit card accounts would have to matched with debit entries in our new account; this implies minus entries so we would end up with an increasingly large negative balance. This of course makes sense because a positive balance in a liability type account implies negative value so a negative balance actually represents positive value, which is what we are trying to accumulate! Of the two types of account, it makes more sense to use an account where a positive balance relates to what we are trying to capture so we will use a special asset type account for these domestic decreases.

These accumulating decreases in amounts and value are a sort of 'bad' asset because they detract from assets available to fund true debts to be passed on to the eventual beneficiaries. Similarly to 'good' liabilities, they should therefore most appropriately be stored in a new style, what I call quasi-asset account, just for accumulating decreases to domestic wealth.

Having now justified the need for two new accounts for holding domestic increases and decreases over a period, one quasi-liability and one quasi-asset account, it makes sense to have a Domestic Changes account where the balances of these Increases and Decreases accounts can be transferred at the end of each period and accumulated to show us over time, for each period, whether we have an overall increase or decrease as our Total Domestic Change (TDC).

Compared to the profit or losses of business accounting, I needed new words to signify a Domestic Surplus or a Domestic Deficit in the TDC. So at the end of an accounting period in a domestic scenario, we would hope to find in our Domestic Changes account, a ‘Domplus’ but sometimes, we maybe be left with a ‘Domicit’.

Adding accounts for accumulating changes over a period, putting asset type accounts on the left and liability type accounts on the right, the DAE is now:

All Asset a/c bals + Decr a/c bal = All Debt a/c bals + Incr a/c bal + DW a/c bal

By keeping the increases and decreases together on one side of the equation, we can see how the changes are derived – note Increases as an asset type a/c is now temporarily on the liabilities side but correctly shown as negative:

All Asset a/c bals = All Debt a/c bals + (Incr a/c bal - Decr a/c bal) + DW a/c bal

Combining the Increases less the Decreases as Change, we have:

All Asset a/c bals = All Debt a/c bals + Changes a/c bal + DW a/c bal

In fact we will have accounts present at all times for increases, decreases and changes but we will accumulate changes only as increases or decreases during an accounting period and at the end of period, transfer balances from these two to the Changes account.

The Increases and Decreases accounts will now have zero balances for the start of the next period and then change as increases and decreases are made during the next period; similarly the balance in the Domestic Changes account is zero throughout the period whilst all the changes are being accumulated and will receive the balances of the Increase and Decreases accounts at the end-of-period when they will then revert to zero ready for the start of the next period.

The balance of the Domestic Changes account will eventually be transferred to the Domestic Wealth account at the end of a period as an increase (for a Domplus) or a decrease (for a Domicit), leaving the balance of the Changes account at zero, also ready for the start of the next period. This summarizes most of the end-of-period accounting activities even though we are looking at theory!

By passing the balances of the Increase and Decreases accounts through the Changes account and on to the Domestic Wealth account, we will accumulate a continuous record of the TDC over the years. This will be of use in our on-going analysis processes for comparisons with past figures.

Now that we see why the domestic Increases, Decrease, Changes and Wealth accounts need to co-exist to facilitate these transfer of amounts amongst them all, let’s have a look at the DAE with all the new asset and liability type accounts returned back to the left and right hand sides, respectively:

All Asset a/c bals + Decreases a/c bal = All Debt a/c bals + Increases a/c bal + Changes a/c bal + DW a/c bal

You will appreciate that if we start off with a balanced equation meaning a balanced set of account balances across the whole equation, any single entry made to any account must disturb the balance. It will only be with balanced pairs of entries into two accounts for each single transaction that balance can be retained.

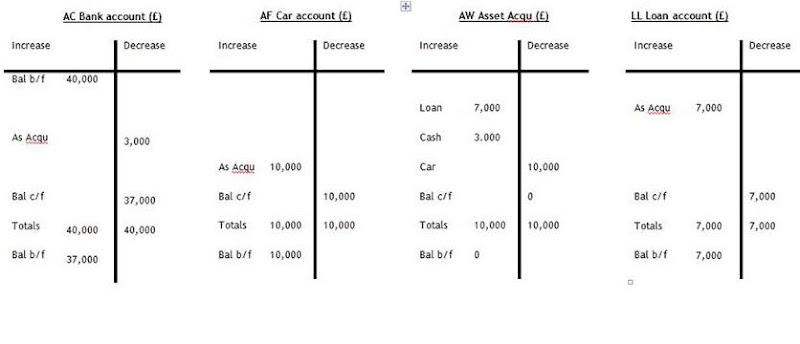

For example, if we start off setting up the domestic accounts for someone with £40,000 in their bank and a personal loan of £7,000 towards a car purchase with no other assets or liabilities, we would need just four accounts where the two pairs of double entries in the first two rows of the four accounts establish the opening balance:

Double entries of £40,000 in cash balanced by the same amount in Domestic Wealth in the first entry below, with a liability established in the Loan account of £7,000 also balanced by the same amount in the bank account in the second entry, illustrate the idea of maintaining balance by ensuring that a debit posting is always matched by a credit posting in each transaction entered.

Remember that an increase in an asset type account (AC Bank) as a debit entry (more value) is matched by an increase in a liability type account (LQ Domestic Wealth) which is a credit entry of less value.

The headings ‘Increase’ and ‘Decrease’ above the two columns in each account refer to increasing or decreasing amounts in the account. This of course is not always the same as the increasing or decreasing value involved. The total of the asset account balances after the first two rows is £47,000 and the total of the two liability accounts for these same two rows is also £47,000 so balance is established. The entries with balances carried forward (c/f) and the associated totals below them are the way used to summarise the situation in an account at any point in order to derive the new balance, shown as balance brought forward (b/f).

The car purchase in the third row using the loan of £7,000 and £3,000 of owner’s cash results in an exchange of value of £10,000 between two asset accounts – the Bank and Car accounts - with no change in Domestic Wealth. The credit entry in the Bank account of a reduced amount and value is matched by the debit entry of increased amount and value in the Car account which happens to be another asset type account (see later for more information of debit, credit and the account name pre-fixes).

The concept of ‘From’ and ‘To’ in relation to entries or postings in accounts for transactions is associated with value and not amounts. This car purchase transaction in the third row illustrates a flow from the Bank account to the Car account since value is transferred From and To these accounts, respectively.

The second row involving liability accounts is not quite so easy to visualise. Here, the Bank receives increased value whilst our account for the Loan company shows a charge or debt that we owe to that company and so the positive amount of £7,000 added to this liability account represents a decrease in value in that account. So the complete transaction represents a transfer of value ‘From’ the loan company (the credit entry) ‘To’ our bank (the debit entry), both as viewed in our accounts from our point of view. It is of interest that in each of the Bank’s and the Loan Company’s accounts, these views would be reversed but we are not actually interested in that!

Also note that in the account at the ‘From’ side, the amount entered has to be under the Increases column because this is a liability type account with a credit entry where an increase in amount means a decrease in value.

Where we have two entries that both involve liability accounts we need to be really clear about what is going on in order to be sure in which direction the flow is going and the relationship in the accounts of the ‘From’ and ‘To’; always remember that the change in value provides the clue and the flow is always from a Credit entry (less value) to a Debit entry (more value). For example (and you will see more about this shortly), accumulated increases from salary will be accumulated over a period in a liability type account called the LQ Domestic Increases account (we are not considering categorisation yet in this example).

Here it is in the accounts:

At the end of a period, the balance in the LQ Domestic Increases account will have to be transferred into another liability type account called the LQ Domestic Changes account. So the implied negative value of the positive balance in the Increases account has to be moved with a decrease, equal to that balance amount (a debit), ‘To’ the Changes account to increase its balance accordingly. Because these accounts are both liability type accounts, we do not really want to move a negative amount so the transaction flow ought to be a positive amount ‘From’ the Changes account (with a credit entry in the Increases column) ‘To’ the Increases account (with a debit entry in the Decreases column). It appears to be the reverse of what we intended but it’s all because liability type accounts hold implied negative amounts. If we did move a negative quantity ‘From’ the Increases account (a debit – negative in the Increases column is less liability so more value) ‘To’ the Changes account (a credit – negative in the Decreases column is more liability so less value) everything would be mathematically correct but it wouldn’t look so good in the accounts with negative quantities being transferred!

To summarise, if we tried to transfer directly from the Increases account to the Changes account we would find that we needed to transfer a negative amount to make it come out right.

Doing it the ‘correct’ way which is not so intuitive, the flow will be entered as an amount under the Increases column as more liability, less value and therefore a credit or expense entry on the ‘From’ side of the transaction in the LQ Domestic Changes account.

Conversely, the actual amount of the balance in the LQ Domestic Increases account on the ‘To’ side of the transaction will have to be entered under the Decreases Column in this account as less liability and therefore more value, reducing the balance to zero – a debit or income entry.

5. Working Accounts

In that last transaction for purchasing a car for £1,000 it is not actually obvious that this amount was made up of both the proceeds of a loan and some cash. By splitting the transaction into parts and introducing another sort of account to mediate the activity, we can make it quite clear in the accounts how it all fits together.

We will introduce what I call a Working Account of the asset type for Asset Acquisitions. Our three transactions involving cash are a receipt of the loan amount of £700, a payment for the car of £300 and an increase in value of the car account from zero to £1,000.

In this Asset Acquisitions account we have accumulated in just one place, all the financial facts about this car purchase. We will be able to go back at any later time and be able to see that we needed a loan of £7,000 and cash of £3,000 in order to buy that car for £10,000.

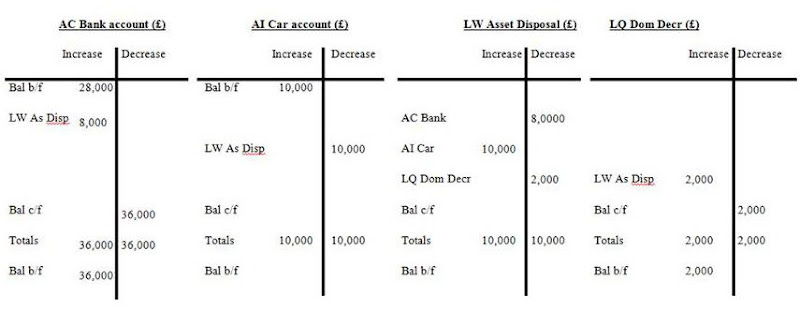

If at a later time, we managed to sell the car for £8,000 let’s look at how we can use another sort of Working Account to mediate the necessary transactions. This time we will introduce an Asset Disposals account and we will make it a liability type Working Account.

The book value of the car is £10,000. This means that the value of the car in our (account) books is £10,000. Its value might have been reduced somewhat in our accounts if we had realised that its value had probably depreciated over the couple of years since we bought it and we had adjusted the books accordingly.

The fact that we have only obtained £8,000 for the car means that we have effectively lost £2,000 and so we must take care to ensure that our Domestic Wealth is adjusted in our accounts to reflect this fact.

If we think about what has happened, we have received an amount of £8,000 and we have disposed of a car which had a value of £10,000 in our accounts. We therefore need to show these facts in our Asset Disposals account. We need to move £8,000 from our Bank account to the Asset Disposals account and we also need to cancel the value of the car by a similar move of £10,000 from our car account to the Asset Disposal account. Let’s do this and see what the situation looks like:

After these first two entries, we can see that there is a balance of £2,000 in the Asset Disposals account which represents the loss on the disposal. The third and last transaction is therefore a double entry to pass this balance as a loss to the Domestic Decreases account for later transfer to reduce the Domestic Wealth account balance by a similar amount.

Give a thought at this point to the ‘To’ and ‘From’ relationship – Is the £2,000 being transferred From the LW Asset Disposal account To the LQ Domestic Decreases account, or vice versa?

Well the liability of £2,000 in the LW Asset Disposal account is to be reduced to zero. A reduction in a liability implies increased value so we will need a debit entry in this LW Asset Disposal account. An increase of £2,000 in the LQ Asset Disposal liability type account means even less value over and above what may have already been there so that implies a credit entry. We have said that the From/To direction of value is ‘From’ credit ‘To’ debit so this transaction will be From LQ Domestic Decreases To LW Asset Disposals. Again, this does not seem intuitive but it is all because of the fact that we are transferring negative value around!

The actual entries will be £2,000 under the Increases column in the LQ Domestic Decreases account for the ‘From’ credit/expense entry and a corresponding entry of £2,000 under the Decreases column for the ‘To’ entry in the LW Asset Disposals debit/income account.

We need to summarise these liability-to-liability transfers by saying that the transfer direction of ‘From’ and ‘To’ is the opposite direction to the perceived movement of positive amounts!

There is also the outstanding loan to be repaid back to the Loan Company although we will not complete that here.

To summarise at this point, Working accounts are those temporary accounts of both asset and liability types for mediating certain transactions and their balances will be cleared to zero either after each batch of mediation work, or finally at the end of each accounting period. This is done by transferring their balances to other non-working accounts, as appropriate. There are a fair number of uses for working accounts, particularly for keeping track of gains, losses, appreciation and depreciation.

6. Categorizing Changes

Controlling finances also requires that we categorize those changes, the increases and decreases, in order to keep track of them all in accordance with the DWB structure. At this point, we come to some differences in approach for implementation of this categorization, depending to the architecture of the accounting package on which we might choose to use to implement our accounts.

Microsoft Money has a categorization capability in-built which is ready-made to implement such a task and is fully described in the book ‘Accounting for a Better Life’. In summary, we can categorize each first half posting of a double entry in accordance with the DWB structure and at the end of a period, determine through a query, the separate totals of all the accumulated categorized increases and decreases. We do not complete the second half of these categorized entries at this time so the accounts are temporarily, unbalanced. We then have to make one final entry with each of these totals, into each of the Domestic Categorized Increases and Domestic Categorized Decreases accounts, respectively. These two entries of these two totals thus complete the double entry process to re-establish financial and mathematical balance throughout the accounts. There could also be some un-categorized increases and decreases so there will be separate accounts for these changes. As before, all the balances from the various sorts of changes accounts end up as a Domplus or Domicit, to be transferred to the Domestic Wealth account.

Personal Accountz uses an architecture more similar to business accounting packages whereby so-called nominal accounts can be established to achieve the necessary categorization. It uses a journal concept for entering transactions whereby the ‘From’ and ‘To’ accounts have to be identified at entry time. With this method, if it were appropriate to keep separate track of income received by the husband and wife of the household for example, accounts such as ‘His Income’ and ‘Her Income’ would be setup and debit entries for money received into the Bank account would have to be matched with credit entries in the His or Her accounts, as appropriate. Now the question is what type of account would be appropriate for such nominal accounts – Asset or Liability?

Well we have already identified a quasi style liability account type for Domestic Increases so it would seem appropriate that we would need further quasi-liability account types for His and Her income categorization together with all the other income categories that make up part of the DWB structure. These are given the account name prefix of LI for Liability (nominal) Increases in DWB accounting. Similarly for the categorization of decreases, asset type nominal accounts will be required and will receive account name prefixes of AD for Asset (nominal) Decreases.

Because categorization and the DWB structure is at the core of DWB accounting, I decided to separately distinguish the two sorts of nominal accounts that I needed for categorizing increases and decreases as Asset Decreases and Liability Increases accounts, respectively. This provides a way to separately identify them with those account name prefixes which we shall look at soon. Any balances accumulated in these nominal accounts during an accounting period have to be transferred to those single Domestic Decreases and Domestic Increases accounts at the end of the period as we discussed previously.

So to complete the picture, here is a more complete view of the DAE for packages such as Personal Acountz using nominal accounts:

All Asset a/c bals + Asset Working a/c bals + Nominal Decreases a/c bals + Decreases a/c bal = All Debt a/c bals + Liability Working a/c bals + Nominal Increases a/c bals + Increases a/c bal + Changes a/c bal + DW a/c bal

For packages such a Microsoft Money based on categorization tags, here is the typical DAE:

All Asset a/c bals + Asset Working a/c bals + Categorized Decreases a/c bals + Decreases a/c bal = All Debt a/c bals + Liability Working a/c bals + Caategorized Increases a/c bals + Increases a/c bal + Changes a/c bal + DW a/c bal

7. Account naming conventions

You will appreciate now that with all these different sorts of accounts making use of the two fundamental overarching account types, it may not always be obvious from an account’s name what it represents in terms of asset or liability type and its actual use – personal asset or liability, good, bad, nominal or working; or where it lies in the DAE.

I resolved this challenge by designating a two-character prefix to be added to every account name.

All DWBA account names therefore are pre-fixed with a two-character group.

- The first character is either A or L to signify Asset or Liability type.

- The second character qualifies the first character to indicate usage, as follows:

| Account Usage | Account Name Pre-fix |

| C - Current Asset | AC |

| F - Fixed Asset | AF |

| I - Investment Asset | AI |

| E – Nominal Expenses | AE |

| W - Working Asset | AW |

| Q - Quasi Asset | AQ |

| Account Usage | Account Name Pre-fix |

| C - Current Liability | LC |

| L - Long-term Liability | LL |

| I – Nominal Increases | LI |

| W - Working Liability | LW |

| Q - Quasi Liability | LQ |

The result of adding all these other accounts and with their prefixes to the DAE is:

Asset type a/c bals (AC, AF, AI, AE, AW & AQ) = Liability type a/c bals (LC, LL, LI, LW & LQ)

Just by looking at any individual account name, its prefix will tell us where it lies in the DAE in relation to all the other individual accounts in our accounts book. [I used to use AD for nominal asset decreases but now prefer AE - asset expenses - as bad assets that are eventually transferred to AQ (also bad) asset accounts].

This will be very helpful when transactions have to be entered during bookkeeping since it will now be very easy to work out allowed pairings of accounts to achieve total balance and to determine which are the ‘FROM’ and ‘TO’ associations. I found it impossible to visualise debit and credit for strange account names which are not easily associated with true assets and liabilities.

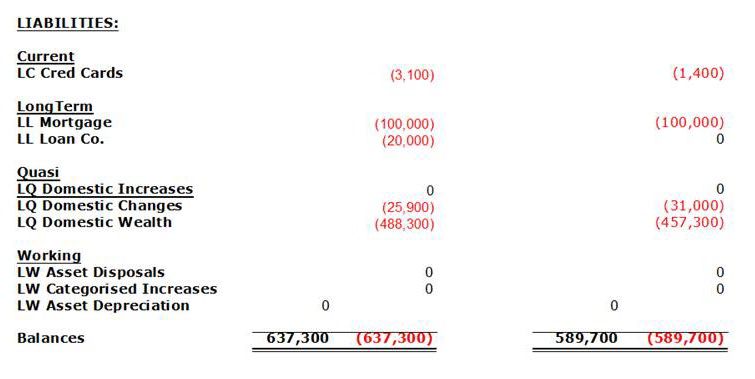

It is quite informative at this point to look at a Trial Balance for a book of accounts. A Trial Balance simply lists all the balances of all the accounts in the accounting system on some particular date. Based on the sample accounts we looked at in the previous blog on Reports, here is a Trial Balance (for two years to show changes) from a set of accounts maintained in Microsoft Money.

You will see how the prefixes enable you to visualize the groupings of accounts as depicted in the last version of the DAE, above. At the time when this trial balance was taken for a set of accounts implemented in Microsoft Money, the Categorized increases and decreases had already been transferred into the LQ Domestic Changes account where you see that value of £25,900 for Total Domestic Change that we saw in the discussion on the Domestic Balance Sheet (DBS) and the Domestic Well-Being Statement (DWBS).

In fact with a little mental agility, you can fairly easily picture from this Trial Balance how the DAE, the DBS and the DWBS are inter-related and how they complement each other.

Of course what does not stand out in this architecture is the categorization of the increases and decreases because they are stored in the category tags associated with individual entries made in the accounts and can only be exposed using a Microsoft query.

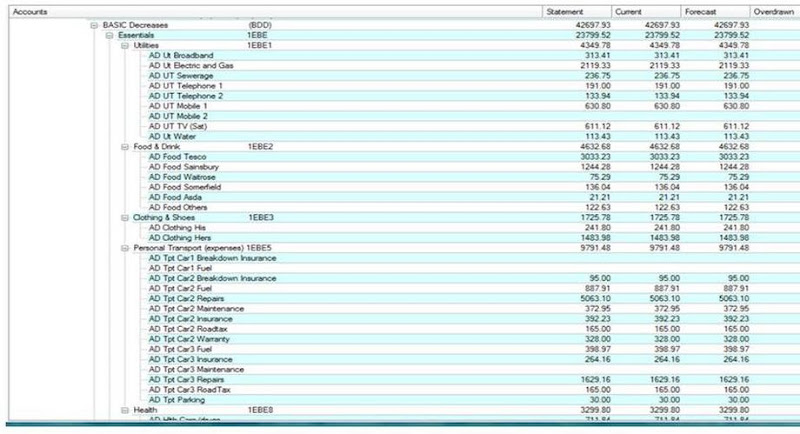

In contrast, a list of the account balances in Personal Accountz displays all the same balances we see in a MSMoney Trial Balance less the Categorized Increases and Decreases accounts, as well as the DWB structure of all the changes as exposed by the balances of all the nominal accounts.

8. Making Use of the Account Types

In our discussion on account name prefixes, you became aware of the various groupings of accounts that are available and may have to be created in a household accounting system, according to a particular household’s needs.

Another powerful capability in Personal Accountz is the ability to define hierarchical groupings of accounts whereby special Group accounts are able to subsume the contents of lower-level accounts defined in the overall account structure.

For those using Personal Accountz, as we add accounts to match the DWB structure, they can be grouped in a similar ‘structure of accounts’ within this accounting package and you saw some of this structure in a previous blog on Reports.

Using Microsoft Money, many fewer accounts will be required as the categorization of increases and decreases is achieved using those category tags that will be created and used to match entries to the DWB structure.

9. Keeping the Accounting Balance

The next important issue is to be able to relate transactions to pairs of accounts.

In Personal Accountz this will be done with the ‘From’ and ‘To’ associations whilst in MSMoney, it will be done by ensuring that entry amounts are entered into the correct account columns for each of the two participating double-entry account entries. Having said this, the majority of the entries will actually only require the first-half of each double entry but this must still be entered in the correct column; and it is the income or expense association to columns that makes this easy, in conjunction with an appropriate memory jogger!

In order to assist the understanding of double entry postings, mathematics state that an equation must be kept in balance by having any addition or reduction in an account on one side of the equation, balanced by an equal addition or reduction in an account on the other side of the equation, respectively. Alternatively, any increase in an account on one side must be balanced by an equal decrease in some other account on the same side of the equation.

In this context, we are talking about increases and decreases in value which you will remember will not always be identical with the increases or decreases in the amounts entered into the accounts, especially for any liability type accounts involved in the pairings.

The accounting rule states that in order to maintain value, a credit entry must always be balanced by a debit entry and so with a little pencil and paper doodling, it is easy to see that when these two rules are combined, for two entries on the asset side of the equation, a debit (increase in an asset) must be matched by a credit (decrease in an asset) or, for two entries on the liabilities side, a debit (decrease in a liability) must be matched by a credit (increase in a liability). Similarly, an increase on the asset side requiring a compensating increase on the liability side must equate to a debit entry (increase in an asset amount) and a credit entry (increase in a liability amount). Conversely, a decrease in value on the asset side as a credit entry (decrease in an asset amount) must be matched with a debit entry on the liability side (decrease in a liability amount).

Portraying this in relation to the DAE, we can easily visualize the four allowable combinations:

Now let’s look at some examples of each type of transaction where we include the effect on the individual account, in terms of:

- ‘To’ or ‘From’ (an account)

- Debit or Credit posting

- Increase (Plus) or Decrease (Minus) – the amount entered in the appropriate account column

- Income or Expense category (Microsoft Money style)

- 1. a. Buy a car – Asset increase and Asset decrease:

- AC Bank (From/Cr/Decrease/Expense) AF Car (To/Dr/Increase/Income)

- 1. b. Buy Food with cash – Asset decrease and Asset decrease:

- AC Bank (From/Cr/Decrease/Expense) AE Food & Drink (To/Dr/Increase/Income

- [AE Food is a bad asset type ‘nominal’ account used for categorization of expenses. At the end of a period its balance will be transferred to the AQ Decreases account and then onwards to the LQ DC and LQ DW accounts]

- 2. a. Receive a Loan - Asset increase and Liability Increase:

- AC Bank (To/Dr/Increase/Income) LL Loan Co (From/Cr/Increase/Expense)

- 2. b. Receive salary – Asset increase and Liability Increase:

- AC Bank (To/Dr/Increase/Income) LI Salary (From/Cr/Increase/Expense)

- [LI Salary is a good liability type ‘nominal’ account used for categorization of increases. At the end of a period its balance will be transferred to the LQ Increases account and then onwards to the LQ DC and LQ DW accounts]

- 2. c. Buy Food with a credit card – Asset increase and Liability increase:)

- AE Food & Drink (To/Dr/Increase/Income) LC Visa CC (From/Cr/Increase/Expense)

- 3. Make Payment to Credit Card Company – Asset decrease and Liability decrease:

- AC Bank (From/Cr/Decrease/Expense) LC Visa (To/Dr/Decrease/Income)

- 4. Transfer Domestic Changes to Domestic Wealth – Liability increase and Liability decrease:

- LQ Dom Wealth (From/Cr/Increase/Expense ) LQ Dom Changes (To/Dr/Decrease/Income

10. Conquer From/To, Debit/Credit, Income/Expense Relationships

I have a notoriously bad memory and I have always found that I need memory joggers to help me recall disparate facts such as those summarized in the examples above.

For each of the combinations above, we have four components:

From/To

Dr/Cr

Increase/Decrease of amounts

Income/Expense

Now depending upon the accounting package you use, not all of these will be relevant at the same time.

For example if you use Microsoft Money with the DWB categorization method, you will be concerned with From/To and Income/Expense.

Personal Accountz will likewise draw your attention to ‘From’/’To’and Increase and Decrease whilst Expense and Income will relate to the Left and Right columns of each account report.

Dr/Cr is not really pertinent to either of these accounting packages but for those familiar with business accounting, Dr/Cr will be all important!

Appreciating that not everyone may like my style of memory joggers, I submit them for your interest and as I find they work for me, I trust that they can help you too.

They are made up of short phrases with an associated image to try to help recall them from memory (to begin with, put them on a sticker on your computer monitor!).

Note that I use Plus in these memory joggers to represent increases of amounts and Minus for decreases of amounts in the appropriate account columns.

So here are my four memory joggers in sequence:

- From an Asset Account: Face Cream in Mexico

FAce Cream in MExico

From/To Asset/Liab Dr/Cr Plus/Minus Income/Expense

To an Asset account: Toad plunking (along a road perhaps)

- From a Liability Account: From A Lily Complex

From a LILY ComPLEx

From/To Asset/Liab Dr/Cr Plus/Minus Income/Expense

In order to make use of these aides, we need to remember the four images and their associated mnemonic phrases and be able to derive the five embedded keywords from each of them.

As always, practice makes perfect and once you start using them along with some accounts, it will very quickly become second nature.

With most accounting, once you get going the great majority of the transactions to be entered will be repeats of ones that you have entered previously with just changes to the dates and amounts so you will hardly even have to remember all these details each time. Most accounting packages have some form of mechanism to recall previously entered transactions as a model for the next entry. Often it will be based on the payee or description text and regularly entered transactions, such as weekly, monthly, bi-monthly or annually payments can usually be stored ready for immediate recall and re-entry after editing.

To begin with, you may well need reminding of the correct ‘From’ and To’ usage as well as which column of an account to use for the entry and whether it is supposed to be an increase or a decrease. This is where these memory joggers are invaluable.

Another useful memory fact is that the two animals – the toad and the mink – are both associated with destination accounts, the To’s.

I will mention again another memory jogger that I find useful which relates to both the Microsoft Money and the Personal Accountz layout of account columns in the order, Expense on the left and Income on the right. E and I go nicely with that favorite old song, Old MacDonald Had a Farm, Ee-Iye, Ee-Iye, Oh!

Now let’s rearrange these images in a useful grid and talk about their typical use:

If we are going to enter a straightforward payment from a bank to a fixed asset account, we can see that we will be interested in the two images in the left hand column:

For the Bank account entry, Face Cream in Mexico reminds us that we are concerned with From an Asset account in the Credit or Expense column and the amount to be entered is a minus/decrease with a single positive amount - not a negative amount with a minus sign!

Likewise, a Toad Plunking along tell us that the other entry will be To an asset account in the Debit or Income column and it will be an increase/plus amount.

There are only two From’s, each with two possible To’s so there are not all that many possible ways or combinations of entries available. In fact all entry combinations have been covered in the different examples that have been discussed previously in this blog so it might be worthwhile re-visiting them in conjunction with these memory joggers.

A last memory jogger that I find helpful is to remember the traditional order in which columns are set out in accounts, which is debit on the left and credit on the right – DC. I just think of a DC battery with its + and – terminals so for an asset account, we have D and + on the left for Debit entries and positive value whilst in the right hand column we have C and – (minus) for Credit entries and negative value.

On the liabilities side, we still have D and C but their polarities are reversed – minus and plus for negative and positive values, respectively. in the Debit and Credit columns.

11. Bookkeeping and Categorising Information

Bookkeeping is concerned with initially setting up the appropriate accounts and subsequently making entries into the accounts in line with the actual financial transactions taking place from day-to-day. Bookkeeping also has to take care of the end-of-period administration involving re-setting the Working, Nominal, Increases and Decreases accounts to derive the new value for Total Domestic Change and transferring its balance to the Domestic Wealth account.

For setting up the accounts, there are two distinct ways of capturing DWB structure data depending upon the architecture of the particular accounting software package used – support for categories or for the nominal accounts used in business style packages for storing income and expenses.

The last main area of potential difficulty for non-accountants relates to usage of the two main columns in each individual account. There is normally one column for Increases/Plus and a second column for Decreases/Minus.

Traditionally in business, debits (Dr.) were always stored in the left hand column of an account and credits (Cr.), in the right hand. The implication here is that positive increases in asset type accounts will be entered in the left column whilst for liability type accounts, regardless of their actual usage, positive entries being credits will be entered in the right column.

With personal accounting software packages these conventions are rarely adhered to and in Microsoft Money for example, the column headings vary according to context so you will see Decrease and Increase, Payment and Deposit as well as Charge and Credit. This product also uses the concept of Expense and Income for the left hand and right hand columns, respectively, in association with the categorization of postings. For this, I have already mentioned the E – I sequence from the song, Old MacDonald had a Farm, Ee-Iye, Ee-Iye, Oh, which is a good reminder!

In Personal Accountz the choice is between account headings of ‘From and To’ or ‘Credit and Debit’. Although not strictly theory, it is relevant to note in this context that Microsoft Money requires two postings for each transaction whereas Personal Accountz uses the business style journal for entries where the two affected accounts for each transaction are identified in a single entry using the From/To concept.

12. Summary

Accounting for domestic finances is accomplished by the use of a personal accounting software package which enables the creation and updating of a collection of accounts created to match the characteristics of a personal or household situation. These include accounts for personal assets (fixed, investment and current), personal debts (current and long-term) as well as all increases and decreases occurring over a period tending to change the amount of household Domestic Wealth.

There are two overarching types of account used in accounting – asset type accounts where positive increases implies more positive value and liability type accounts where positive increases represent charge of debt implying negative value.

For a complete accounting solution, it will be necessary to implement a double entry system which includes a minimum of one extra account in which to store Domestic Wealth. Other associated accounts may be useful to keep separate records of domestic increases, decreases and the resulting Total Domestic Changes (TDC) over any period.

Double entry accounting involves maintaining the balance of an established set of accounts by ensuring that every transaction includes two postings to match any increase of value by a corresponding decrease of value, appropriately in the accounts.

The basic domestic accounting equation states that total personal assets less personal liabilities equals domestic wealth. Domestic Wealth is a ‘good’ liability representing the value of the household owed to its eventual beneficiaries.

The structure of changes highlighted in the Domestic Well-Being structure requires detailed visibility which is achieved either by the use of nominal accounts or categorization of transactions according to the architecture of the accounting package employed.

The inter-relationship between all the different individual accounts is depicted in the Domestic Accounting Equation (DAE), together with the allowed transaction double entry pairings:

Please rememer that the balance I have been concentrating on in this blog is the balance that has to be maintained in the Domestic Accounting Equation to help with the bookkeeping and the correct entering or posting of transactions in double entry accounting.

This must be distinguished from the balance we will seek across the overall set of domestic accounts for a household with DWBA. Here the focus is on maximising Domestic Well-Being which is finding the best possible balance across the decreases (expenses) based on the available increases (income).

Finally, we have a series of memory joggers to tie all these different facts together:

Face Cream in Mexico

From Asset Credit Minus Expense

From Lily Complex

From Liability Credit Plus Expense

Toad Plunking

To Asset Debit Plus Income

Tilted Mink

To Liability Debit Minus Increase

For the Expense/Income column relationship in Microsoft Money and Personal Accountz:

Old MacDonald had a farm, Ee-Iye, Ee-Iye, Oh!

Debit and Credit (Traditional Column layout):

| Asset Account | Liability Account | ||

| Dr. Cr. | Dr. Cr. | ||

| + - | - + |

copyright © 2006 John M Passmore